What is a Penalty?

A penalty is a fine for the underpayment of taxes.

This fine is not a set amount (like a parking ticket) but it’s calculated as a percentage of the outstanding tax.

If you owe £1,000 in tax and they set the penalty at 50 percent you will be asked to pay £1,500.

In April 2009 HMRC introduced a new (and tougher) system of penalties.

The question HMRC ask themselves is this: have you been Deliberate and Concealed, just Deliberate, or Negligent / Careless.

Deliberate and Concealed

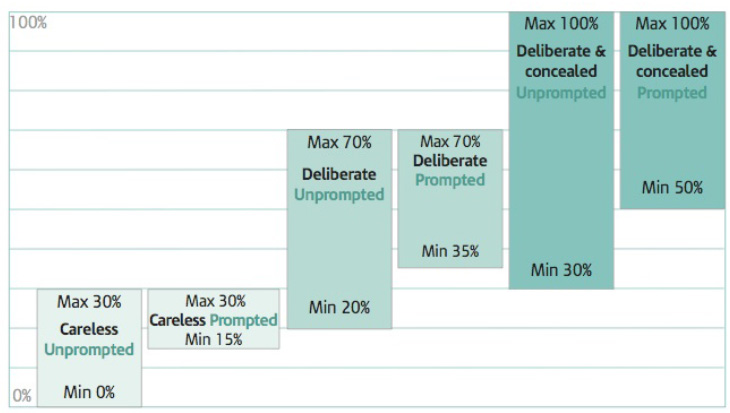

Deliberate (you knew it was wrong and you meant to do it) and Concealed (you tried to hide it from HMRC). This is then subdivided into Unprompted (you made a full confession to HMRC without HMRC so much as lifting a finger) and Prompted (HMRC did something that made you come forward). For this the maximum is 100 percent of the outstanding amount and the minimum is 30 percent – you cannot negotiate lower than 30 percent under normal circumstances.

Just Deliberate

This is when you were Deliberate (you knew it was wrong and you meant to do it) but you didn’t try to hide it. This too subdivides into Prompted and Unprompted. There is a maximum of 70 percent and a minimum of 20 percent. So you can really see how attractive HMRC have made it for you to come forward and confess unprompted, it’s a bit carrot.

Careless / Negligent

In this category HMRC feels you’ve been negligent in your financial affairs – they say careless but they mean negligent. So you haven’t tried to defraud the State, you just haven’t attended to your tax affairs in the way you should. This too subdivides into prompted and unprompted and has a maximum rate of 30 percent and a minim of 0 percent.

No penalties apply if “reasonable care” has been taken. HMRC will take the line that if you had taken reasonable care you wouldn’t have made a mistake / error in the first place. You can take the line that you did everything in your power to keep proper records and make accurate Self Assessment returns, but the system was much more complex than you expected. To which HMRC will say, well you should have got an accountant to help you then. To which you can then argue that there is no legal requirement to have an accountant and HMRC do tell everybody how easy it is to do a return (“Tax Needn’t Be Taxing” remember?) it was on that assumption that you decided to make the return on your own.

If you’ve used an accountant and there have been errors it’s still your responsibility, but you can argue that you went to a third party to get advice and help and you – reasonably – acted on that information.

Here’s the chart:

Even though things have toughened up on the penalty front there is still plenty of room for negotiation. Also, if HMRC are demanding penalties in earlier years (before the system was toughened up in April 2009) that section of the penalties should be reduced as they fall under the old – less harsh – system.

Confused yet? Well it is complex, but it all comes down to a bit of haggling: HMRC will stick on a penalty of X percent because of A, B and C and you have to argue your side. HMRC will be expecting this, and when they ‘stack’ their penalty demands they do so with haggling in mind.

If you are being hit for a high percentage as a penalty and HMRC won’t budge you might want to take your case to an ADR or the Tribunal – sometimes just threatening HMRC with the Tribunal is enough to make them take a more sensible position.

• • •

After closure notices are issued you will have 30 days to appeal. If you accept the HMRC figures they will become binding to all parties, if you appeal HMRC can revise the ‘final’ figures.

In my case the closure notices were for just over £6k, when I appealed HMRC doubled that figure to an eye watering £12k (just to put the scarers on me really) then (after a year of negotiation and a month before the appeal hearing was due to take place) HMRC reduced their figure to just over £4k. The whole case took just under four years.