Tips to make completing your Tax Return a little less painful – Some timely advice from the good people at Holder & Combes

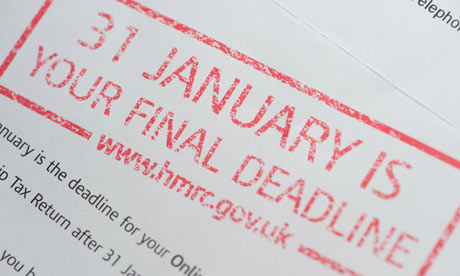

With only a few weeks left before the tax return submission deadline for 2010/2011 and Moira Stewart’s stern but friendly reminders still ringing in the back of your mind, now is the time to tackle that tax return!

With only a few weeks left before the tax return submission deadline for 2010/2011 and Moira Stewart’s stern but friendly reminders still ringing in the back of your mind, now is the time to tackle that tax return!

Whether self employed or employed, this unpopular annual event is very often left to the last minute. Some want to delay paying any additional tax due until the 11th hour, while others have simply had more interesting things to do since April last year!

With this in mind, we have put together some tips to help ease the pain of completing your return.

1. Is this for you?

Many people are routinely sent tax returns to complete, even when there is no actual current requirement for them to complete one. If you earned less than £44,000 in the year from 6th April 2010 to 5th April 2011, and have no other income from shares or property, then it is well worth contacting HMRC to ask if you should really be completing one at all.

2. Register for online submission

If you definitely will be completing a return, the online submission is without doubt the quickest and easiest way to get your details to the tax man. A few swipes at your i-Pad and a few numbers in the right boxes, and this should be a pretty straight forward exercise. This task might not necessarily be the weekend-ruiner you had been dreading.

3. Don’t be late!

£100 fine for missing the deadline, and then you could be charged interest on any tax due. The only thing worse than paying tax is paying fines for paying tax and then interest on the tax and fines that you are paying! Also, new in for 10/11, even if there is no tax to pay and a return is late, the £100 fine applies anyway!

4. Get yourself organised

If you are attempting to tackle this 10/11 return only now, after almost 10 months of careful deliberation of course, it is well worth digging out and collating all of the bits and pieces of information that you are going to need before you set about the forms. To bake this tax return cake, best to line up all the ingredients in advance to ensure a tasty output.

5. Find those receipts – where did you leave that shoebox?

For self-employed people, any money spent “wholly and exclusively for business purposes” can be added up and deducted from all the money billed during the tax year:

Typical items might be the cost of stock, payroll costs, premises costs, repairs, motor and travel expenses, finance costs, administration costs, professional fees…

6. Fetch the speedo from your bike!

You can claim up to 20 pence per mile for distances travelled on your bicycle in the pursuit of your business. I am always surprised how far I have pedalled and when tax is due, every penny off the dreaded bill is worthwhile.

7. Pension Contributions

Don’t forget to include your personal pension contributions – if you are lucky enough to be a higher or additional rate tax payer and wise enough to be making personal pension contributions, then it may be the case that HMRC will owe you money! Personal contributions attract a maximum of 20% relief straight away. For each gross contribution you made, you could be owed another 20% or even 30%.

8. Invest in some good coffee

Before launching into this task, brew some strong coffee and log out of Facebook. Submission of a tax return is a serious business, declaring your income and gains is a legal requirement so your full concentration is recommended!

9. Gift Aid

Money you generously donated to charity is not all lost! Including these donations on your return could mean a reduction in the tax you pay in a similar way to pension contributions. If you are a higher rate tax payer for example and have already allowed the charity to claim gift aid – for every £100 you donated you can personally claim £25 back. If you are a signed up user of giving websites such as JustGiving – you can log in and print off a list of all donations from there.

10. Don’t include ISAs!

Many people pour over their ‘tax advantaged’ ISA statements trying to see what information is required. Put that statement back in the draw and move on, ISAs are out of equation.

11. Online banking

Some bank’s online banking let you go back and search for items. For example: If you have misplaced the annual bank interest certificate your bank sent you back in April/May last year, then you can search for ‘interest’ received.

12. Capital allowances

Again for the self employed – the value of certain assets you may have bought for your business are not tax deductible, instead you might be able to claim so called ‘capital allowances’. These allowances are designed to give you credit for the reducing value of the assets through an effective reduction in income tax.

13. If it gets complicated – ask for help.

Seeking advice or guidance from a suitable accountant or financial planner could save you time and money. Many friendly professionals will be happy to clarify some points on the phone at no charge. Before spending hours scouring google, it might be worth picking up the phone.

Ed Holder, JAN2012

This was published in The Times today, but can only see it if you subscribe. The content is taken from the www.holderandcombes.co.uk website and can be seen in full here.