Another reader wins – this time by going to the top

When somebody is successful in a HMRC investigation I think there is value in publishing the details, so others can use it as a model.

In a nutshell PS had been working as a chef for many years on a PAYE basis. HMRC informed him that he’d been on the wrong code and he owed a few £100. This was paid, HMRC then said that he’d been self-employed and he’d failed to fill-out a self assessment form and he’d failed to pay tax. PS explained that he’d always worked PAYE and had NEVER been self-employed but HMRC was not having it.

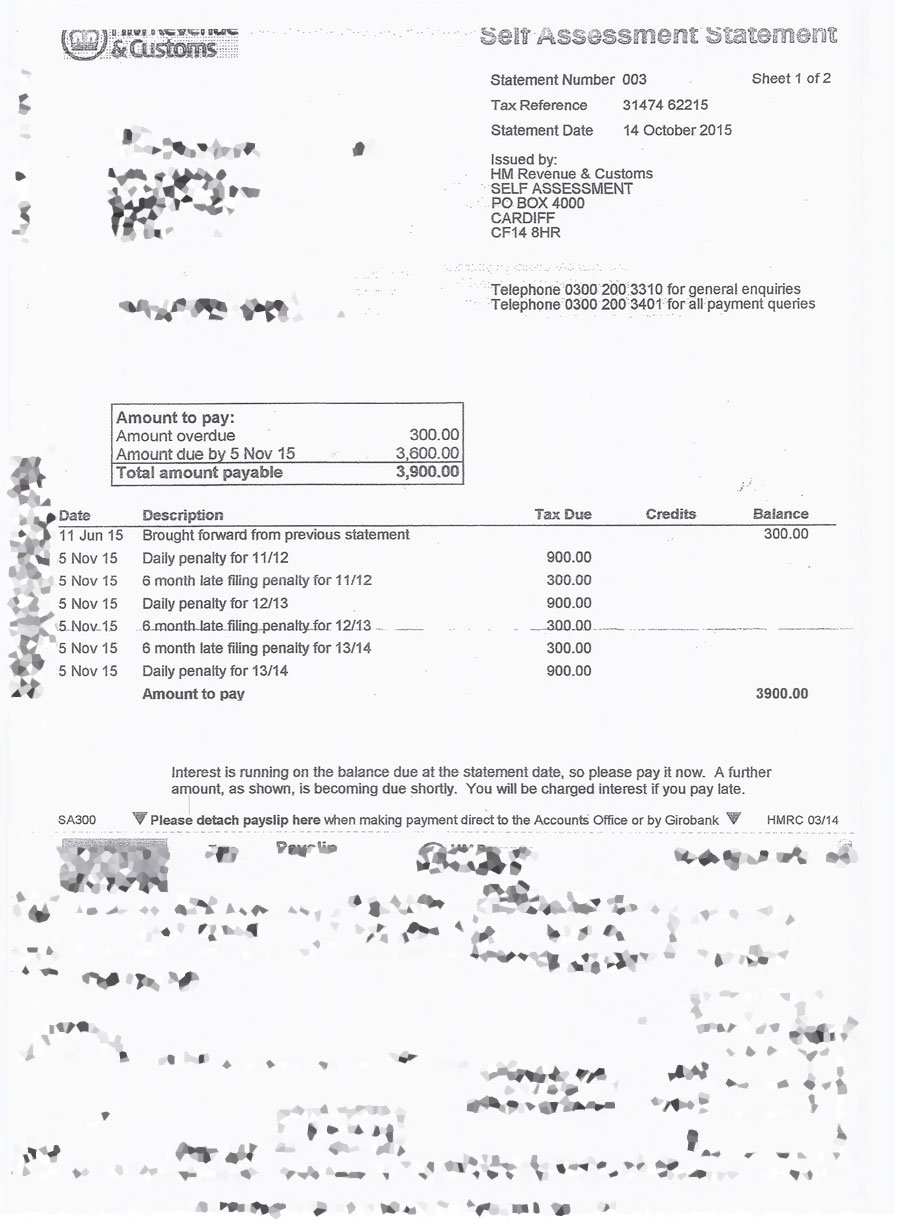

HMRC demanded self-employment tax of £300. Penalties accrued at a rate of £10 a day and up. Soon the demand was for just under £4k.

PS’s grandmother VB (who is the hero of this piece) tried to deal with this in a number of ways (documented below) nothing was successful. Then she wrote an email direct to of of the HMRC top brass. The case was closed in the next day.

The following documentation is published to help people in a similar situation.

PS letter to HMRC

PS letter to HMRC

Penalty Letter from HMRC

Penalty Letter from HMRC

Demands grow from HMRC

Letter from VB to HMRC boss Ruth Owen

From: VB

Sent: 11 November 2015 07:47

To: ruth.owen@hmrc.gsi.gov.uk

Subject: Please Please can you help us

Dear Ms. Owen

I do apologise for bothering you when I’m sure you must be extremely busy. However I just cannot receive any answers

From my several phone attempts to get through to the office concerned and being 77 years old & under my Doctor (Dr. P*** M***)

For Stress I just HAD to do something to try and sort this Nightmare out. I will try to keep it a short synopsis to explain:

A few months ago this year our Grandson PS received a tax request for underpayment of Tax he assumed they

Had the wrong person as he has never been self employed and relied/assumed his employer’s paid his taxes i.e. deducted from

His wages. However when he received another letter in August from the Cardiff CF14 8HR saying he had penalties amounting to £600

And getting higher day by day he wrote (please see attached).

This where it becomes hard for him as he is a Chef at The **** ****, ****** in The New Forest in Hampshire, his working hours

Are unpredictable, they are not allowed to use the Hotel’s phones (only I assume in emergencies) and apart from that his mobile when

He is off duty sometimes works but being in the middle of The New Forest cannot always get a strong signal, sometimes can even be

cut off in the middle of a call. Therefore he did write (please see attached) however still just kept receiving demand letters from Cardiff,

and they just seemed to ignore his attempts to find out & understand how he could be Self assessed, he is an artistic person and really

doesn’t understand exactly what to do as no one at this point was replying to his query.

That is when his Mother our Daughter M (who is a Teacher) tried to help by contacting the Tax Office, so I said I would try also try to

help sort it out, we found out that the outstanding amount underpaid was £136. So I paid the £136 by my Visa Debit card (P then sent me the money)

– this was one of the times after waiting on hold for ¾ of an hour on Tel: 03002003310 when I did speak to a very pleasant Lady Jeannie

(who told me not to worrying) as she said if they queried it give them this payment Reference number: Ref.08051002 . However this STILL

did not make a difference Paul then received a letter (by the way some of the letters which Cardiff said they sent must have got lost between his home address (ADDRESS GIVEN BUT WITHHELD) and (ADDRESS GIVEN BUT WITHHELD) as he did not receive the earlier ones.

Then we received this horrifying letter saying P owed HMRC £3,900 which was growing everyday – M said he appealed but it was declined as he was self assessment?? SO PLEASE, PLEASE MS. OWEN DO HELP US, as this is really breaking us all up Paul is worried, his Mother M his extremely concerned. We are just an ordinary hard-working middle class family we have never asked for help.

I love Christmas and this is really upsetting me every day as he hasn’t this kind of money & if it is increasing everyday, I just cannot take this much more.

Please Help us sort this out I have tried several times to get through but you have to hang on for ages, sometimes I just have to hang up.

This is the reason Ms. Owen I am, in pure desperation, contacting you. Thank you so much for reading this I await in anxiety for your reply,

Yours very very Sincerely,

Mrs. V B

Reply from HMRC boss – via Karen Keeley, Customer Service Adviser

From: karen.keeley1@hmrc.gsi.gov.uk

Sent: 12 November 2015 12:14

To: VB

Subject: HMRC Complaint Reply

Complaint ref- *************

Dear VB

Thank you for your email of 11 November 2015 to the Director General on behalf of your grandson Mr PS.

I am sorry for the difficulties Mr PS has had in dealing with our department and the concern caused.

I have reviewed our records for Mr PS and cancelled all of the Penalties that we charged him. He now has nothing to pay.

I have also sent a letter to Mr PS to confirm this.

Yours Sincerely

Karen Keeley

Customer Service Adviser

HM Revenue & Customs

Complaints Service

03000 512693

VB says:

You’d have thought somebody somewhere at HMRC could say sorry for this rather monumental error, but no.

[…] AHave a read through this, it sounds like a similar case. https://taxhell.co.uk/another-reader-wins-with-hmrc/Ruth Owen has (unfortunately) moved on from her post as director general at HMRC Customer […]

[…] when HMRC have made a clear and simple mistakes and have then dug their collective heels in – for example saying the tax payer is self employed when they are not – it just takes somebody in authority to pick up the phone and say, “WTF I want this […]