The HMRC Charter and how it can help you

HMRC has a Charter which sets out to tell you “what you can expect from us and what we expect from you [in an investigation]” earlier this year the wording changed. So what is the Charter, how can it help you and how has it changed?

The fist time I read the Charter I thought it was a joke; the HMRC guidelines promise to, “respect you” and to “act with integrity” and to be “be non-judgemental”. But the real kicker for me was this promise, “Do all we can to keep the cost of dealing with us as low as possible”.

And why is this so funny? Well simply because HMRC have a bottomless pit of resources and they exploit this; often in cases where there is little or no evidence of wrongdoing a common tactic is to send out a stream of letters asking for more and more documents. The more evidence you give the more they will ask for – after a few years they hope you will settle just to end the (very expensive) nightmare – and many do.

I spoke with tax experts about the Charter and they said I was wrong to dismiss the guidelines as a joke. The Charter, they said, was a very useful tool for people being investigated; if HMRC don’t stick to their own guidelines they can be held to account for it, and that’s a big deal.

Now just as most Christians can’t name all 10 Commandments you will find that most tax investigators can’t remember the Charter so you will have to remind them of their own guidelines on a regular basis, you can download a copy of the Charter here.

In January this year AccountingWEB ran a story called “HMRC quietly alters taxpayer charter” where Rebecca Cave, AccountingWEB’s tax policy editor said, “I believe [HMRC have] removed the condition to keep the costs of dealing with HMRC at a minimum.”

Here is what has actually changed:

The old Charter says, We will do, “all we can to keep the cost of dealing with us as low as possible” and today that line has been altered to, “We’ll… keep any costs to you at a minimum.”.

See the difference? I can and it shifts power towards HMRC.

But what this change flags up to me is how sensitive HMRC are about the wording of the Charter and that suggests to me that this is a weak chink in the HMRC armour.

Generally chapter and verse of the Charter is not used in investigations, but it should be, if you are dealing with an investigator who is constantly asking for irrelevant information you can quote the Charter and ask them to justify their demands.

UPDATE: Following the post The HMRC Charter (above) here’s an update from Rebecca Cave giving a picture of how the goalposts are being moved and the impact it has on you

The charter is important as it governs the relationship between HMRC and taxpayers, and also the separate but important relationship between HMRC and the taxpayer’s representatives.

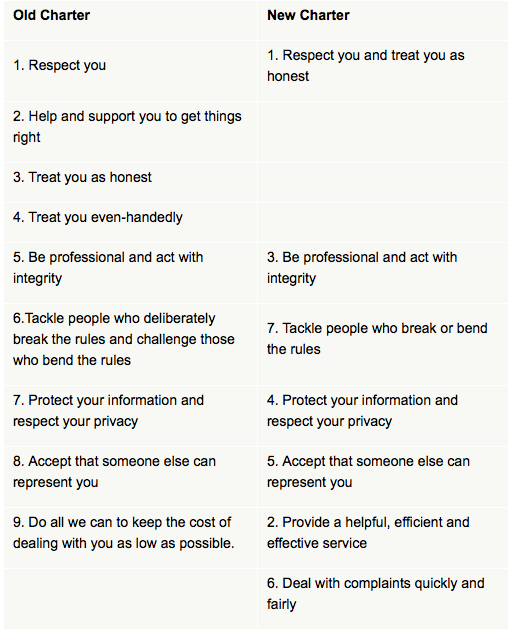

I am concerned that the relationship between the taxpayer and the tax authority looks very different under the new charter compared with the old. I have set out the old and new obligations for each party under the charter in the tables below. The new obligations are matched where possible to the equivalent old wording.

HMRC obligations

The notable omission from the new obligations for HMRC is number 9: to keep the costs of dealing with the taxpayer as low as possible. Within the old charter this was explained as HMRC aiming to take up as little of the taxpayer’s time and money as possible. This target must have been difficult to meet while taxpayers and tax agents were waiting an average of 38 minutes to speak to human at HMRC (2015 survey by Which), and paying for the cost of those wasted minutes.

The new charter takes the emphasis off costs, and instead highlights “efficiency and effectiveness”. This means HMRC will deal with information quickly and efficiently, but doesn’t aim to answer the phone quickly or efficiently, although the detail in the new charter does say “and keep any costs to you at a minimum.”

The other omission that worries me is number 4: to treat taxpayers even-handedly. Under the new charter this obligation appears to have been rolled into number 1: respect you and treat you as honest. However, I feel that a lot has been lost in this new interpretation as the old charter said HMRC would:

• act within the law and our published guidance

• help you understand your legal rights

• explain what you can do if you disagree with our decisions or want to make a complaint

• provide you with information in a way that meets your particular needs

• consider any financial difficulties you may be having.

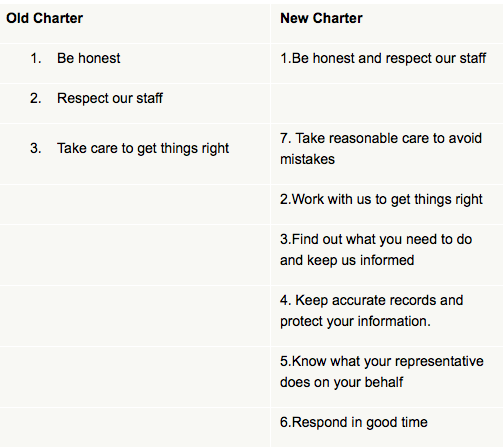

Taxpayer’s obligations

The taxpayer’s obligations under the old charter were very simple – just three things to remember. The new charter adds six new obligations. I can’t argue with numbers 3 and 4 as the tax law requires the taxpayer to keep accurate records, and to understand what their tax payment and filing obligations are.

However, I am not happy about number 2: work with us to get thing right. The detail behind this obligation says the taxpayer should: talk to us if there is anything you’re not sure about. Also under obligation number 3 the taxpayer is urged to: get in touch with us as soon as possible if you need help. Tell us straight away if you’re having trouble meeting your obligations. So the obligation is on the taxpayer to contact HMRC, but how is the taxpayer supposed to do that if HMRC won’t answer their phones or reply to letters?

The obligation that really sticks in my throat is number 6: respond in good time. This means submitting tax returns on time, paying tax by the due date and paying penalties and interest promptly. That is all reasonable for the taxpayer, but why is there no balancing obligation on HMRC to respond to letters in good time, answer the phone within five rings and refund tax without delay?

The HMRC goal of dealing with complaints quickly and fairly is not an equivalent to responding in good time, although it has been placed next to that obligation for the taxpayer.

Full article on accountingWEB here.

[…] ‘HMRC has recently been given greater powers. It is being asked by ministers to collect more tax with fewer staff. These cultural drivers may have pressured staff to take a more aggressive approach to tax collection, and in doing so impaired the ability to be fair to taxpayers and act in accordance with charter values.’ […]