Hi To Everybody Who’s Come To The Blog Through The Sunday Times…

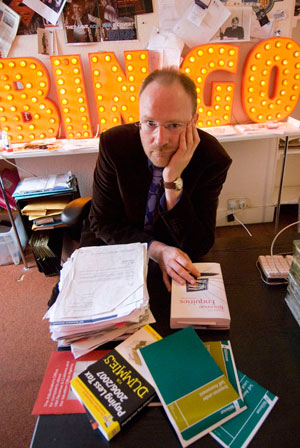

I work as a freelance journalist so this website is normally written in the early hours of the morning. Below is “the director’s cut” of the Sunday Times article published last week. It goes into more detail and names names. It’s rare for mainstream journalism to be critical of HMRC – so this is quite a win, Enjoy.

Her Majesty’s Revenue & Customs are constantly telling us “Tax doesn’t have to be taxing” So – like over four million of us – I completed my own Self Assessment return and when I got a letter saying an enquiry was being opened into my tax affairs I wasn’t frightened, I had nothing to hide – what a naive fool

No detail was too small to question, a £10 David Beckham autobiography – which I’d bought for research – quickly became of great interest. Senior inspector Jacqui Lamper asked, “Are there any documents to show that you purchased the David Beckham book in the belief that you would get to interview him? Otherwise there is nothing that shows that it was not purchased for your own enjoyment.”

Beckhamgate went on over nine months, two interviews and many letters. This was the beginning of a Kafkaesque nightmare.

Jacqui Lamper presented me with a frightening blur of figures on stacks of official headed paper – each getting progressively more daunting. Further years were opened for investigation and more documents were requested, bank and credit card statements were examined with forensic intensity. In the second interview there was talk of my negligence, large amounts of tax to pay and penalties too. Patches of eczema started to break out all over my body.

In January last year [2007] I used the 1998 Data Protection Act to get copies of my HMRC file – which is something anybody can do. Two months later the true picture of the investigation emerged. Jacqui Lamper – so bullish on the phone and on headed paper – admitted in an email to a colleague, “I haven’t insulted him, mostly I was… trying to make him go away.” And in a separate email she continued talking about the case, “I’m feeling a bit lost in all this… [it’s] not a large settlement.”

HMRC don’t calculate costs on individual cases so it’s impossible to find out the exact price to the taxpayer. Stephen Camm former Inland Revenue Investigator and now head of tax investigations at Price Waterhouse Coopers says, “In a case like this it’s reasonable to estimate figures of £50,000 for the investigation and that figure may well double with appeals .” And how much tax does HMRC hope to get back? Well the figures change with the wind, but in September last year [2007] they sent closure documents setting it at just £2,530.

Here are 10 things you need to know about tax investigations and what HMRC would rather keep quiet.

Tax is not simple

Advertising front man Adam Hart-Davis who has been delivering the “Tax doesn’t have to be taxing” line for five years walked out of his job in January [2008] saying that our tax system is too complex, especially for the self-employed and VAT, he said, was “absurdly complicated”.

The National Audit Office estimated that a third of all Self Assessment returns are incorrect and that’s not surprising when you consider that a recent Civil Service Capability Review admitted one in four of us contacting HMRC for advice is given, “incomplete or inaccurate information.” It’s all so complicated they can’t even get it right themselves.

They lie and you get the allowances you negotiate

When a tax inspector opens a case he simply looks at a list of expenses and says, “That’s not allowable, that needs to be reduced to 80 percent. And do you get personal enjoyment from this? OK well we will have to reduce that…” When your expenses are eroded your profits shoot up – et voila – the taxman gets a result. Inspectors are well within their rights to question expenses, but if they say something is not tax deductible – when they know it is – that is lying.

In my case I put in expenses of just under £4,000. Every item was questioned from newspapers and magazines (valid research for a journalist) to my office rent. After a year I was told I’d be allowed just £1,000 of that figure – an unrealistic reduction. I dug my heels in and stuck to my guns; the figure went up to £2,500 and then to £3,000.

Stephen Camm says this is typical. “In investigative cases there is a strong element of negotiation, and it’s likely that the investigating officer saw the offer of £1,000 as a starting figure. Tax investigations are like sport, you need to know the rules: if you play Lacrosse without knowing the basics you are going to get hurt.”

They bend the legal boundaries

There is legislation in place to protect taxpayers, unfortunately some inspectors choose to ignore it. When an investigation is opened it’s normally an ‘aspect enquiry’, which means that the investigator can only enquire into a narrow band of information. If they suspect wrongdoing the investigation becomes a ‘full’ enquiry, and if a ‘discovery’ is made the previous 20 years can come under enquiry.

‘Discovery’ is the inspector’s nirvana: but what constitutes ‘discovery’ is a grey area open to interpretation. Stephen Camm says, “HMRC will say that they have made a discovery at the drop of a hat, we then have to question what that discovery is.”

John Whiting from the Low Incomes Tax Reform Group, an organisation that give a voice to those who cannot afford to pay for tax advice says, “The unrepresented taxpayer is at a huge disadvantage in an investigation, particularly if the inspector says a discovery has been made. There are certainly inspectors who will try it on. You have to understand, the job they are paid to do is to collect the tax, not to help the taxpayer.”

You are guilty unless you can prove otherwise

Under criminal law you are innocent until proven guilty, the tax system turns this on its head: the burden is on you to prove your innocence. Let’s say your grandmother gave you a cheque for £100 for your birthday four years ago. HMRC will seek out your personal statements and question where that amount came from, if you can’t explain and provide proof they will most likely assume that the money is undeclared income and you will be taxed on it.

The interview is a trap

In criminal investigations you are cautioned that what you say may be used against you – no such niceties are offered by HMRC. You can be represented – which HMRC is very vocal about – but then there are other rights they prefer to keep quiet. You can have the interview at the location of your choice, you can ask for a detailed agenda of the meeting beforehand and you can also record the interview – an invaluable tool.

Accountant Ken Frost of the www.hmrconline.com blog says, “Under no circumstances should anyone attend an interview with HMRC personnel without propper representation. HMRC staff are incentivised to maximise the tax take therefore it is in their interests to skew records of meetings in their favour.”

Stephen Camm adds, “Importantly taxpayers should know that an interview is voluntary – most don’t realise this and feel compelled to attend.”

The lifestyle questionnaire is given for a reason

The lifestyle questionnaire is often used by HMRC and is designed to entrap the taxpayer. If HMRC can’t find any evidence they will s

imply look at your lifestyle, calculate your living costs as X and they know that your declared income is Y. They will then simply send you a bill for the tax on the difference between the two. It’s the perfect investigation: evidence free.

I was sent a questionnaire just after my first interview. It looked innocent enough; three pages asking about everything from mobile phone bills to holidays and haircuts. I filled it in as honestly as I could – but it was little more than guesswork so I wrote “All figures are estimates” on the first and last page – that has not stopped HMRC using these figures as one of the principle tools in their investigation.

They bully

HMRC know that accountants are expensive so they drag the investigation out before presenting a settlement offer. The settlement may be unfair, but the option is to go on paying high accountancy fees for months, possibly years. Former enquiry officer and author of Dealing with Revenue Enquiries, Michael Reader says, these are ‘face saver’ tactics and adds, “The accountant should not allow the client to be subject to any form of unfair settlement.” But the reality is most accountants are pragmatic and HMRC banks on this.

The complaints team is an arm of investigation

Whatever you say to the complaints team is noted down, attached to your file and passed back. They make judgements about how determined you are or if you are angry, well informed or well mannered. Notes obtained through the Data Protection Act on my case read, “…he said he is prepared to go all the way – even to his MP.” And “He sounded agitated & frustrated, but well mannered & polite.”

They don’t tell you about their power to scale back

You are the subject of a protracted and stressful investigation but just when you are suitably stressed and scared the taxman will dangle a carrot in your direction. This is a settlement figure that (you believe) will make the nightmare go away. The figure will be a little higher than you were expecting – but it’s possible to pay it at a stretch, say £5,000.

Once you’ve signed on the dotted line real figures start to emerge. The £5,000 is scaled back, normally over five years (the theory is what you did wrong in one year you did in five) making the figure £25,000 then HMRC add interest (increasing the figure by at least another £5,000) and penalties too. So what starts out as £5,000 can quite easily knock a hole in £50,000 – and once you have agreed to the initial £5,000 HMRC have got you.

This happened to me in the early stages of the investigation. After the case had been open for a year (it’s now been open for almost three years) I got a letter saying, “I’m now in a position to settle my enquiry and propose the following…” but the following figures contained no mention of penalties, interest or scaling back. It was only after talking to an accountant that I learned what would happen. He pointed to my letter and laughed, “That figure,” he said, “is just the tip of the iceberg.”

They are getting more power

Stephen Camm says ”Staff cuts have undeniably increased workloads, lowered skill levels and savaged HMRC staff’s morale.” What is the response of the government? Give them more power. Rob Lewis Practice Editor at accountingweb.co.uk says, “HMRC now have the power to bug [only in criminal cases] and from next April [2009] they will have the right to carry out surprise spot-checks. This could result in people like you or me being questioned with no representation or advice.”

HMRC was asked to comment but declined.